Cryptocurrencies are a relatively new phenomenon, but they’re quickly becoming a big part of our lives. And while many people are still trying to get their heads around this complex concept, there is one thing that everyone can agree on: Bull markets and Bear markets are two very important concepts to know about.

In this blog post, we will explore the basics of these two market trends so that you can better understand the concepts behind cryptocurrencies. By doing so, you will be in a much better position to make informed investment decisions.

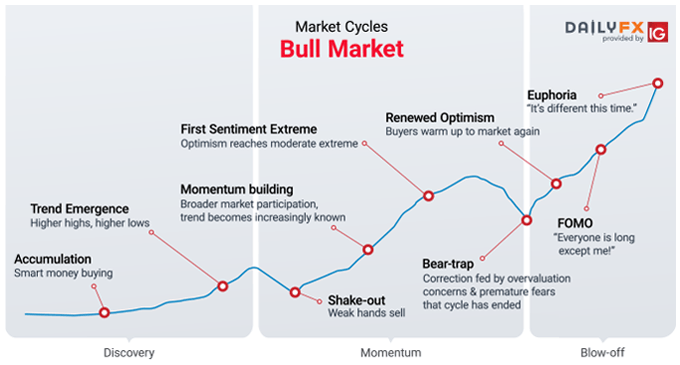

What is a Bull Market?

A bull market is a period of time when the prices of stocks, commodities, and other financial assets are higher than they have been in previous periods. In a bull market, investors feel that these assets are undervalued and expect their prices to increase.

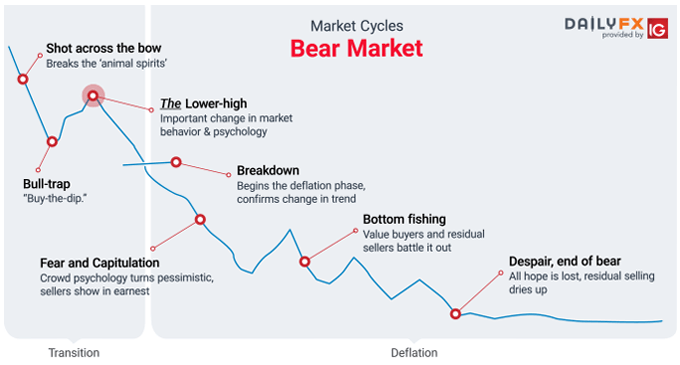

In a bear market, investors feel that these assets are overvalued and expect their prices to decrease. This pessimism leads to a decreased demand for the asset, which in turn drives down its price.

What is a Bear Market?

A bear market is a period of time where the price of a certain asset, such as stocks or cryptocurrency, falls below a previously established level. A bear market can be considered to be an indication that the underlying asset could decline in value further.

Typically, stock prices will rise and fall in a cyclical fashion; however, this is not always the case with cryptocurrencies. Cryptocurrencies have been known to experience long and short-term fluctuations in their prices, which can result in a bear market. There is no definitive answer as to why these fluctuations happen; however, some theories suggest that it may be due to uncertainty surrounding the digital currency space or regulatory changes.

How do Cryptocurrencies work?

Cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are digital or virtual assets that use cryptography to secure their transactions and control the creation of new units. Transactions are verified by network nodes through cryptography and recorded in a publicly distributed ledger called a blockchain.

An important property of cryptocurrencies is that they are decentralized: there is no government, company, or individual in charge of them. This allows for more secure transactions and a higher level of transparency than traditional financial systems.

Bitcoins were created in 2009 by an unknown person or group of people under the name Satoshi Nakamoto. They were designed as a currency that could be used without the need for a central authority or bank. Bitcoin is mined with powerful computers using algorithms called PoW (Proof-of-Work).

The best buying and selling times

There is no one answer to this question – it depends on a variety of factors, including the current market conditions and your personal investment goals. Generally speaking, however, experts generally recommend buying stocks in a bull market and selling them in a bear market. Here’s why:

1) In a bull market, prices are climbing higher and higher. This means that there is more demand for stocks than there is supply, which means that they are getting more expensive (in terms of both absolute and relative terms). This means that you can make a lot of money by investing in stocks during a bull market.

2) In contrast, during a bear market, prices are falling lower and lower. This means that there is more supply than demand, which means that they are getting cheaper (in terms of both absolute and relative terms). This means that you can lose money by investing in stocks during a bear market.

Overall, it’s important to understand the concept of a bull market vs. a bear market so you can make informed decisions about when to buy or sell stocks.

Trading cryptocurrency

When you think about investing, what comes to mind? Likely, the idea of buying stocks in a company that you believe has a promising future. Cryptocurrencies are similar to this concept, but they also involve buying and selling digital assets.

Cryptocurrencies are digital or virtual coins that use cryptography for security. Bitcoin is the first and most well-known cryptocurrency. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. The value of cryptocurrencies is based on supply and demand. There is no physical representation of a cryptocurrency, like dollars or gold bars.

When people invest in cryptocurrencies, they are typically doing so because they believe the currencies will continue to grow in value. This is known as a bull market. Bull markets happen when there is an increase in the number of buyers and sellers of cryptocurrencies, which creates upward pressure on their values. During a bear market, however, there may be less demand for cryptocurrencies, which can lead to their price decline.

Conclusion

Cryptocurrencies are a new and exciting investment concept that is still being explored. In this blog, we will discuss the differences between bull and bear markets.

Bull markets are periods of rising prices in cryptocurrencies. This means that the value of cryptocurrencies is increasing, and there is more demand than supply. During a bull market, investors are usually optimistic about the future of cryptocurrencies, and they are willing to invest more money into them.

Bear markets are periods of falling prices in cryptocurrencies. This means that the value of cryptocurrencies is decreasing, and there is more demand than supply. During a bear market, investors are usually pessimistic about the future of cryptocurrencies, and they are willing to sell off their holdings in them.