On Thursday, the cryptocurrency market continued its upward trajectory following Federal Reserve Chair Jerome Powell’s message that the central bank’s rate-hiking campaign may soon come to an end, given ongoing concerns about the stability of the global banking system.

Not only did crypto traders take advantage of this opportunity to enter the market, but U.S. equities also showed an upward trend in early trading, dipped briefly midday, and closed with a surge higher, with the S&P, Dow, and Nasdaq increasing by 0.44%, 0.42%, and 1.01%, respectively.

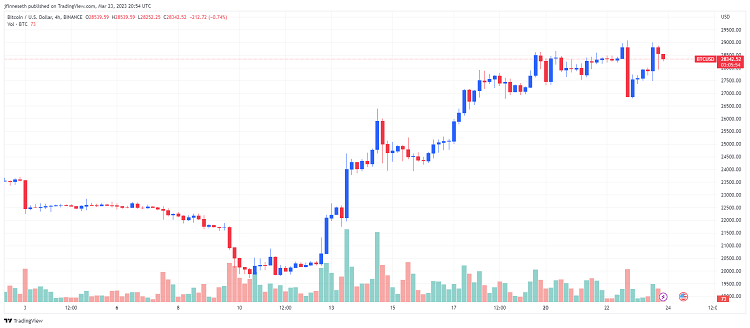

According to TradingView data, Bitcoin (BTC) initially dipped below $27,000 on Wednesday, but then rebounded to reach an intraday high of $29,000 on Thursday. It subsequently pulled back to a support level of $28,300, which has been consistent for the past week.

According to Youwei, the recent instability in traditional finance due to high interest rates has led to the re-emergence of Bitcoin’s narrative as a safe haven asset. This has highlighted the benefits of self-managed money through wallets and DeFi for high net-worth individuals, rather than relying on banks or fund managers. Despite recent regulatory scrutiny dampening momentum, statistics show that a large amount of money is still flowing into the crypto ecosystem, particularly into Bitcoin.

Bitcoin’s recent surge, almost doubling from its FTX crash low of $15.8K to surpass $28K and come close to $29K, is attributed to this narrative and money flow. However, the recent SEC lawsuit against Justin Sun, the founder of TRX, may lead to some selling pressure if the impact spreads.

Youwei suggests that there may still be one or two more significant drawbacks in the crypto market this year due to potential global liquidity issues and enforcement actions by regulators. However, things are expected to ramp up for a bull market in 2024 and 2025. The overall cryptocurrency market cap now stands at $1.18 trillion, and Bitcoin’s dominance rate is 46%.